GO BEYOND RISK MANAGEMENT

IMF Expectations for Global GDP Growth in 2025: Steady Growth with Increasing Risks

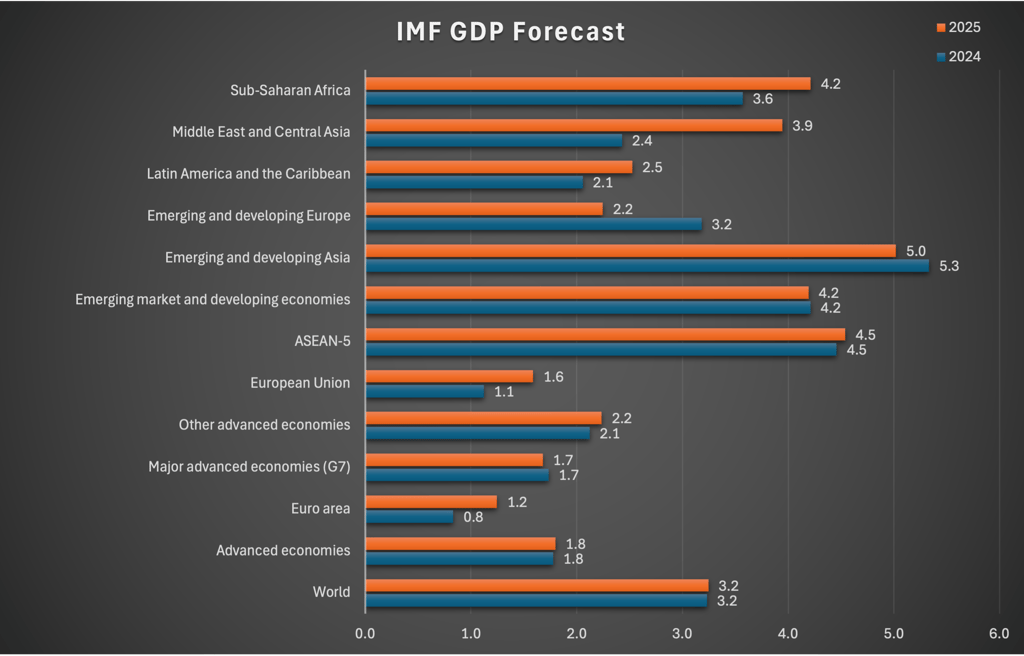

The International Monetary Fund (IMF) projects global GDP growth to remain steady at 3.2%, supported by strong performances in advanced economies, while highlighting the need for policy adjustments in the face of rising geopolitical and economic challenges.

Moises Marcos

10/23/20242 min read

Policy Pivot, Rising Threats

The International Monetary Fund (IMF) projects global GDP growth to remain steady at 3.2% for both 2024 and 2025. This forecast is supported by strong performance in advanced economies, particularly the United States, which is expected to grow at 2.2% in 2025 due to resilient consumer spending. In contrast, emerging markets such as India and Brazil show robust growth expectations, projected at 6.5% and 2.2%, respectively, for 2025. Meanwhile, China's growth is anticipated to decelerate to 4.8% in 2024 and 4.5% in 2025. Similarly, Mexico's growth prospects are lower, with projections of 1.5% in 2024 and 1.3% in 2025.

Following a significant decline from a peak of 9.4% in annual inflation in mid-2022, headline inflation is expected to normalize around 3.5% by the end of 2025, slightly below pre-pandemic averages. Although the inflation landscape has improved, some regions, especially low-income and developing economies, continue to face adverse impacts from conflicts and sectoral weaknesses.

Despite these positive trends, the global economic environment remains precarious, necessitating a shift in policy approaches to effectively bolster growth and manage emerging risks.

Major Downside Risks and Threats

Escalating Geopolitical Conflicts. Rising tensions, especially in the Middle East, pose risks for commodity markets and could lead to spikes in oil prices, impacting global inflation and economic stability.

Financial Market Volatility. The potential for sudden tightening in global financial conditions due to market repricing in response to tighter monetary policies could hamper investment and growth, particularly in emerging markets.

Weakness in Emerging Markets. Continued sluggishness in China’s property sector could further depress global demand and consumer confidence, leading to negative spillover effects.

Protectionist Policies. An increase in trade barriers could exacerbate global trade tensions, disrupt supply chains, and slow advancements in productivity and integration.

Climate and Environmental Challenges. Extreme weather events and supply disruptions linked to climate change might threaten both agricultural output and overall economic resilience, disproportionately impacting vulnerable nations.

Upside Risks

Investment Recovery in Advanced Economies. Accelerated public investment aimed at infrastructure and green energy initiatives could stimulate economic activity and crowd in private sector investment, enhancing growth potential.

Momentum for Structural Reforms. If advanced and emerging economies can accelerate structural reforms, productivity growth may improve, yielding better long-term economic outcomes.

Global Trade Recovery. A resilient recovery in global trade, particularly driven by technological advancements and investments in digitalization, could boost demand and economic growth.

Increased Multilateral Cooperation. Strengthening international partnerships and frameworks may facilitate better coordination in trade and climate actions, fostering a more stable global economic environment.

Resilience in Labor Markets. Robust lab or market conditions, supported by immigration and workforce reintegration efforts, may bolster consumer spending, further stimulating economic growth.

Key Takeaways

The IMF's outlook reflects a cautious optimism for sustained global growth considering improving inflation dynamics, yet underlying vulnerabilities necessitate vigilant policy adaptations. Policymakers need to navigate these complexities through coordinated actions to stabilize economies, enhance productivity, and mitigate risks.

Disclaimer

This content is meant for information only.

Why SOAR Risk Intelligence...

Apply Risk Intelligence and gain resilience, create new capabilities, and capitalise on opportunities faster and effectively in your risk management oversight. Our team of experts can assist you in strengthening, developing, and transforming the way you manage risks by applying international best practices, advanced analytics, and artificial intelligence in an ever-evolving business landscape.